Business Insolvency Company: Custom-made Solutions for Business Financial Obligation Management

Business Insolvency Company: Custom-made Solutions for Business Financial Obligation Management

Blog Article

Discover the Numerous Aspects and Procedures Associated With Seeking Bankruptcy Providers for Financial Security

Browsing the complexities of insolvency services is typically an essential step in the direction of accomplishing monetary security in difficult times. From decoding the different types of bankruptcy to abiding with lawful procedures and needs, the journey towards economic recovery is loaded with essential choices and implications.

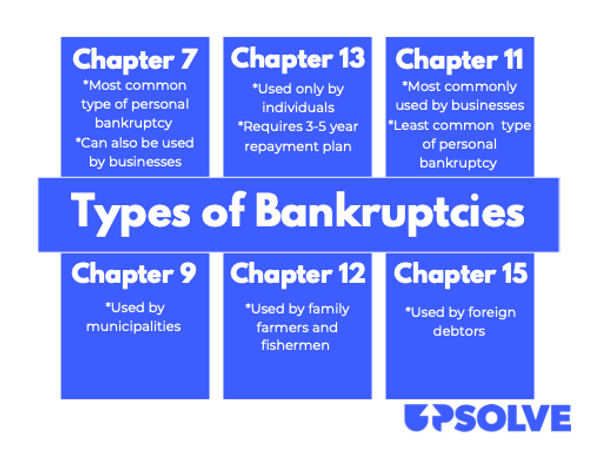

Recognizing Insolvency Types

Discovering the various kinds of insolvency can offer a thorough understanding of the financial obstacles individuals and organizations may encounter. Bankruptcy can materialize in various types, each with its very own effects and legal proceedings. Both main kinds of insolvency are capital insolvency and equilibrium sheet insolvency.

Cash money flow insolvency takes place when an individual or company is unable to pay off debts as they come due. On the other hand, balance sheet insolvency occurs when the overall liabilities of an entity exceed its overall possessions.

Understanding these differences is critical for companies and people looking for insolvency services - Business Insolvency Company. By recognizing the kind of insolvency they are encountering, stakeholders can collaborate with bankruptcy specialists to develop tailored services that address their details financial situations

Legal Procedures and Requirements

Browsing the intricacies of lawful treatments and demands is vital for individuals and services dealing with insolvency. When dealing with monetary distress, recognizing the lawful structure bordering insolvency is critical for an effective resolution.

In addition, complying with lawful demands such as offering precise economic details, participating in court hearings, and accepting bankruptcy specialists is important throughout the process. Sticking to timelines set by the court and conference reporting obligations are additionally crucial elements. Furthermore, comprehending the legal rights and obligations of all parties entailed, including creditors and debtors, is critical for a reasonable and transparent bankruptcy procedure. By following the lawful treatments and demands vigilantly, individuals and services can browse the bankruptcy procedure efficiently and function towards achieving economic security.

Ramifications of Bankruptcy Actions

Understanding the implications of bankruptcy activities is essential for businesses and individuals seeking economic stability. When an entity becomes insolvent, it symbolizes an inability to satisfy economic responsibilities, resulting in various repercussions. One significant implication is the prospective liquidation of properties to pay back creditors. This procedure includes liquidating properties to generate funds, which can result in significant losses for the insolvent celebration. Furthermore, insolvency activities can bring about damage in credit score scores for people and services, making it testing to secure car loans or credit rating in the future. In addition, bankruptcy might likewise lead to legal actions taken versus the entity by financial institutions to recuperate financial debts owed. This can cause long term litigation processes, better influencing the financial standing of the bankrupt event. Comprehending these ramifications is necessary for making informed decisions relating to insolvency proceedings and looking for ideal support to browse through these difficult circumstances properly.

Functioning With Insolvency Professionals

In collaboration with knowledgeable bankruptcy businesses, individuals and professionals can efficiently browse intricate financial difficulties and check out calculated remedies for sustainable recuperation. Insolvency experts bring a riches of competence in financial restructuring, insolvency regulations, negotiation techniques, and court treatments to the table. Their support can be important in examining the economic situation, recognizing sensible choices, and creating a thorough plan to resolve insolvency problems.

Collaborating with bankruptcy professionals entails an organized technique that generally begins with a complete analysis of the economic condition and the underlying causes of bankruptcy. This analysis assists in creating a customized approach that lines up with the specific demands and objectives of the specific or service encountering insolvency. Insolvency professionals also play an essential function in helping with interaction with financial institutions, discussing negotiations, and representing their customers in legal proceedings if essential.

Protecting Financial Security With Bankruptcy

Offered the strategic advice and experience offered by click here for info insolvency individuals, companies and experts can currently concentrate on executing procedures focused on securing economic security with bankruptcy process. Insolvency, when handled successfully, can serve as a device for reorganizing debts, renegotiating terms with financial institutions, and inevitably recovering financial wellness. With bankruptcy procedures such as financial obligation liquidation, reconstruction, or restructuring, services and people can address their financial challenges head-on and job towards a lasting economic future.

Protecting monetary stability with insolvency requires a thorough understanding of one's monetary situation, a sensible assessment of debts and properties, and a critical plan for moving on (Business see this website Insolvency Company). By functioning carefully with bankruptcy businesses, individuals and specialists can navigate the complexities of insolvency process, adhere to lawful requirements, and make informed decisions that line up with their long-lasting monetary objectives

Verdict

Finally, looking for bankruptcy services entails comprehending the different sorts of bankruptcy, adhering to lawful procedures and requirements, and taking into consideration the effects of insolvency activities. Collaborating with insolvency experts can assist individuals and organizations browse the process and work towards protecting financial security. It is necessary to very carefully take into consideration all aspects of bankruptcy before proceeding to ensure a successful result and long-lasting economic health and wellness.

The 2 primary types of bankruptcy are money circulation bankruptcy and balance sheet insolvency.

Insolvency professionals bring a wealth of competence in monetary restructuring, bankruptcy regulations, arrangement approaches, and court treatments to the table.Functioning with insolvency experts involves an organized approach that typically starts with an extensive analysis of the monetary standing and the underlying causes of bankruptcy.Offered the calculated guidance and expertise provided by bankruptcy individuals, services and specialists can now focus on carrying out measures aimed at securing financial security via insolvency proceedings.In verdict, looking for bankruptcy services entails comprehending the different types of bankruptcy, adhering to legal procedures and needs, and taking into consideration the implications of insolvency navigate to this website activities.

Report this page